Applying for a Money View personal loan in 2025 is quick, easy, and completely online. Whether you need funds for an emergency, home renovation, wedding, or travel, Money View offers instant personal loans from ₹5,000 up to ₹10 lakh with fast approval and low interest rates.

In this article will walk you through everything you need to know before applying for Money View personal loan 2025.

In this post, we’ll cover:

✔ How to apply online (step-by-step)

✔ Latest interest rates & charges (2025)

✔ EMI calculator & repayment tips

✔ Eligibility & documents required

✔ Customer reviews & pros/cons

Why Choose Money View Personal Loan in 2025?

Money View is a popular digital lending app in India, offering hassle-free loans with minimal paperwork and quick disbursal. Here’s why many borrowers prefer it:

Key Benefits of Money View Personal Loan

- Quick Disbursal: Get funds within 24 hours of approval.

- Paperless Process: No physical documents—everything is done online.

- Flexible Loan Amount: Borrow from ₹5,000 to ₹10 lakh based on eligibility.

- Competitive Interest Rates: Starting at 14% p.a. (varies with credit score).

- No Collateral Needed: Unsecured loan (no need for property or guarantor).

- Easy EMI Repayment: Auto-debit facility ensures timely payments.

Who Should Consider Money View Loan?

- Salaried professionals needing emergency funds.

- Self-employed individuals looking for quick business loans.

- People with moderate credit scores (CIBIL 650+).

- Borrowers who want instant approval without bank visits.

Money View Personal Loan Eligibility Criteria (2025)

Before applying, ensure you meet these eligibility conditions:

1. Age Limit

- Minimum Age: 21 years

- Maximum Age: 57 years

2. Income Requirements

- Salaried Individuals: Minimum ₹13,500/month in-hand salary.

- Self-Employed: Minimum ₹15,000/month income.

3. Credit Score

- Minimum CIBIL/Experian Score: 650 (better rates for 750+).

4. Employment Stability

- Salaried: At least 3 months in current job.

- Self-Employed: 1+ year in business (ITR/bank statements required).

5. Bank Account

- Must have an active bank account where salary/income is credited.

Documents Required for Money View Loan (2025)

The application process is 100% paperless. You only need to upload:

1. Identity Proof

- PAN Card (mandatory)

- Aadhaar Card / Passport / Voter ID

2. Address Proof

- Aadhaar Card / Utility Bill / Rental Agreement

3. Income Proof

- Salaried: Last 3 months’ payslips + 6 months’ bank statements.

- Self-Employed: 6 months’ bank statements + ITR (if applicable).

4. KYC Verification

- Live selfie + PAN card photo.

Pro Tip: Ensure all documents are clear and unedited for faster approval.

How to Apply for Money View Personal Loan Online (2025 Step-by-Step Guide)

Applying for a Money View loan is simple and takes less than 10 minutes. Follow these steps:

Step 1: Download the Money View App or Visit Website

- Available on Google Play and App Store.

- Alternatively, visit their official website.

Step 2: Enter Basic Details

- Fill in your name, mobile number, PAN, monthly income, and employment type.

Step 3: Check Loan Offer

- The app will instantly display eligible loan amount, interest rate, and tenure options.

Step 4: Complete E-KYC Verification

- Upload PAN + Aadhaar and take a live selfie for verification.

Step 5: Set Up Auto-Debit for EMI Payments

- Link your bank account or debit card for automatic EMI deductions.

Step 6: Receive Loan Amount

- Once approved, the money is transferred within 24 hours (often sooner!).

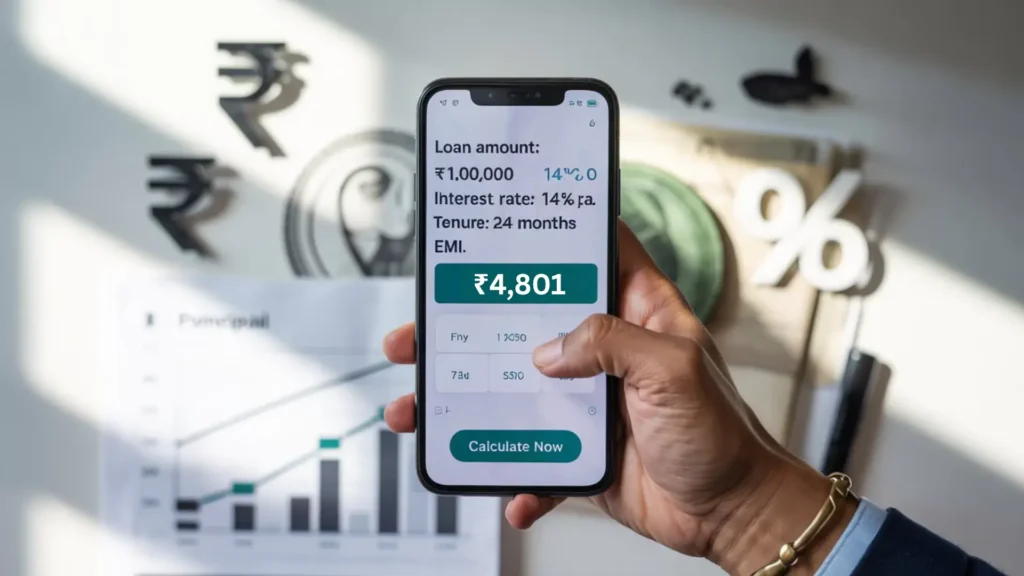

Money View Personal Loan Interest Rates & Charges 2025

It is important to understand the cost of borrowing. Here are the latest details:

1. Interest Rates

- Starts at 14% p.a. (can go up to 24% for low credit scores).

- Example:

- Loan: ₹1,00,000

- Interest: 14% p.a.

- Tenure: 2 years

- EMI = ₹4,801.29/month

2. Processing Fee

- 2% – 4% of loan amount (deducted upfront).

3. Late Payment Penalty

- 24% p.a. + GST on overdue EMIs (avoid this!).

4. Prepayment Charges

- Zero fees if repaid early (check latest terms).

Money View EMI Calculator – Plan Your Repayment Smartly

Worried about EMI burden? Use this simple formula:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

- P = Loan amount

- R = Monthly interest rate (annual rate ÷ 12)

- N = Tenure in months

Or use Our EMI calculator for instant results!

Example Calculation:

- Loan: ₹2,00,000

- Interest: 15% p.a.

- Tenure: 3 years (36 months)

- EMI = ₹6,933/month

Pro Tip: Opt for shorter tenures to save on interest.

Top 5 Alternatives to Money View personal Loan (2025)

Compare interest rates, eligibility, and key features of similar apps:

1. Bajaj Finserv

- Loan Amount: ₹20,000 – ₹40 lakh

- Interest Rate: 10%–32% p.a.

- Tenure: Up to 8 years

- Pros: Higher loan amounts, longer tenures.

- Cons: Requires ₹25,001+ monthly income

2. IDFC First Bank

- Loan Amount: Up to ₹10 lakh

- Interest Rate: From 10.99% p.a.

- Tenure: Up to 5 years

- Pros: Low rates, good for existing bank customers.

- Cons: Longer approval time (~48 hours)

3. KreditBee

- Loan Amount: ₹1,000–₹5 lakh

- Interest Rate: 17%–29.95% p.a.

- Tenure: 3–36 months

- Pros: Instant approval (10-minute disbursal).

- Cons: Short tenures; high rates

4. Fibe (EarlySalary)

- Loan Amount: ₹5,000–₹5 lakh

- Interest Rate: From 12% p.a.

- Tenure: 3–24 months

- Pros: No credit score needed for first-time borrowers.

- Cons: Smaller loan limits

5. Navi

- Loan Amount: Up to ₹20 lakh

- Interest Rate: From 9.9% p.a.

- Tenure: Up to 6 years

- Pros: Lowest rates in market.

- Cons: Requires high credit score (700+)

Key Takeaways

- For Low Rates: Navi (9.9%) or IDFC First Bank (10.99%) 7.

- For Quick Cash: KreditBee (10-minute approval) or Money View (24-hour disbursal) 7.

- For Large Amounts: Bajaj Finserv (up to ₹40 lakh)

Money View Loan Reviews 2025 – Real User Feedback

Pros (What Users Like)

✔ Instant approval & disbursal (some get money in 2 hours!)

✔ No physical paperwork (100% online process)

✔ Good for average credit scores (CIBIL 650 accepted)

✔ Transparent charges (no hidden fees)

Cons (Common Complaints)

✖ High interest for risky profiles (up to 24%)

✖ Strict income checks for self-employed

✖ Customer support delays during peak times

Rated 4.8/5 on Google Play Store (2025), praised for speed but criticized for high costs for subprime borrowers

Money View Customer Care: Contact Details & Support Timings (2025)

If you need assistance with your Money View personal loan, you can reach their customer support via phone, email, or in-app chat. Here’s how:

- Customer Care Number 08069390476 (Available 9 AM–7 PM, Monday to Saturday)

- Email Support: [email protected] (Response within 24–48 hours)

- In-App Chat: Open the Money View app > Go to “Help & Support” > Tap “Chat with Us” (24/7 automated responses, human agents during business hours)

Best Time to Call? Avoid peak hours (12 PM–3 PM) for faster resolution. For urgent issues like loan approval delays or EMI disputes, calling early in the day (9 AM–11 AM) works best.

Pro Tip: Keep your loan application number handy for quicker service!

Final Advice – Should You Apply?

Good for:

✔ Urgent cash needs (medical, travel, etc.)

✔ Those with CIBIL 650+

✔ Borrowers who want hassle-free online process

Avoid if:

✖ You have very low income/credit score

✖ You need long tenures (beyond 5 years)

FAQs – Money View Personal Loan (2025)

#MoneyViewLoan2025 #InstantPersonalLoan #LowInterestLoan #QuickCashOnline #EMICalculator