Your credit score is like a financial snapshot – it shows banks and lenders how well you manage money. In India, a strong score can get you better loans, lower interest rates, and easier approvals for credit cards. If you’re wondering how to improve your credit score fast in India, you’re in the right place. Thanks to new 2025 rules from the Reserve Bank of India (RBI), improving your score can happen faster than ever. Here’s how to make it work.

- Research suggests paying bills on time is the top way to lift your score quickly.

- It seems likely that keeping credit card balances low makes a big difference.

- The evidence leans toward checking your credit report often to catch mistakes.

- New 2025 RBI rules mean your score updates every 15 days, speeding up progress.

- It’s advisable to avoid applying for too many loans to keep your score safe.

What’s a Credit Score and Why It Matters

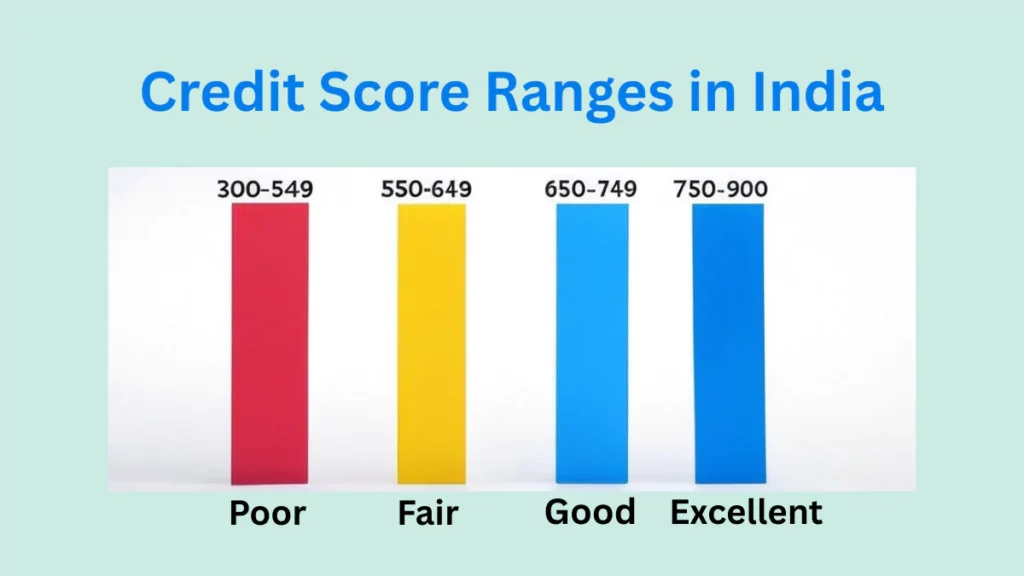

Credit score is a number between 300 and 900 that sums up how trustworthy you are with borrowed money. In India, companies like CIBIL, Equifax, Experian, and CRIF High Mark calculate it. CIBIL is the most popular, and a score of 750 or higher is considered great. A good score means better chances of getting loans or credit cards with lower rates.

Why Your Credit Score Matters

A credit score is a three-digit number (300-900) that shows how well you handle borrowed money. In India, four main credit bureaus—CIBIL, Equifax, Experian, and CRIF High Mark—calculate it. CIBIL is the most used, and banks check it before approving loans or credit cards. A score of 750 or above is excellent, while below 550 is poor. A higher score means:

- Easier loan approvals for things like a personal loan.

- Lower interest rates, saving you money.

- Better chances for premium credit cards or higher credit limits.

If your score is low, don’t panic – there are steps you can take to improve it, and recent changes make it faster.

How Credit Scores Are Calculated

Your credit score comes from a combination of factors, each with a different weight, so understanding these helps you focus on the most important factors to boost your score.

| Factor | Weight | What It Means |

|---|---|---|

| Payment History | 35% | Do you pay bills and loans on time? Late payments hurt the most. |

| Credit Utilization | 30% | How much of your credit limit you use. Lower is better (under 30% is ideal). |

| Length of Credit History | 15% | How long you’ve had credit accounts. Older accounts help your score. |

| Types of Credit | 10% | Having both secured (e.g., car loan) and unsecured (e.g., credit card) credit. |

| New Credit | 10% | How many new accounts or applications you’ve made recently. Fewer is better. |

The Game-Changing 2025 RBI Updates

In January 2025, the RBI rolled out new rules to make credit scores more accurate and up-to-date. Here’s what’s new, based on reports from sources like Business Standard:

- Bi-Weekly Updates: Banks now send your credit info to bureaus every 15 days, not monthly. This means your score reflects changes faster – like paying off a loan or clearing a credit card balance.

- Better Accuracy: More frequent updates reduce errors and outdated info, giving lenders a clearer picture of your finances.

- Faster Results: If you start paying bills on time, you could see your score improve in weeks, not months.

Proven Strategies to improve your credit score fast in India

Below are eight practical ways to boost your credit score, with tips to make them work for you:

1. Pay All Bills on Time

Paying bills on time is the biggest factor, making up 35% of your score. Missing even one payment can drop your score significantly, so staying on top of due dates is key.

How to do it:

- Set up auto-payments for credit cards and loan EMIs.

- Use apps like Cred or your bank’s app to send payment reminders.

- If you’re short on cash, talk to your lender about flexible payment options before missing a due date.

2. Keep Credit Utilization Low

Credit utilization—how much of your credit limit you use—counts for 30% of your score. Aim to use less than 30% of your limit. For example, if your credit card limit is ₹1 lakh, keep your balance below ₹30,000.

Tips:

- Pay your card balance before the billing cycle ends to lower reported usage.

- Ask for a higher credit limit, but only if you won’t overspend.

- Spread spending across multiple cards to keep each one’s utilization low.

3. Check and Fix Your Credit Report

Mistakes on your credit report, like a payment marked late when it wasn’t, can hurt your score. Checking your report regularly helps catch these errors.

Steps:

- Get a free annual report from CIBIL or other bureaus like Equifax.

- Look for wrong details, like accounts you didn’t open or incorrect balances.

- Dispute errors online with the bureau—most fix issues within 30 days.

4. Avoid Too Many Credit Applications

Applying for multiple loans or cards in a short time triggers hard inquiries, which can lower your score. Each inquiry might shave off a few points, and too many can make you look risky.

What to do:

- Research loan options before applying to pick the best one.

- Use pre-qualification tools that don’t affect your score.

- Space out applications by at least 3-6 months.

5. Maintain a Healthy Credit Mix

Having different types of credit—like a car loan (secured) and a credit card (unsecured)—shows you can handle variety. This makes up 10% of your score.

How to manage:

- Don’t take new loans just to diversify—only borrow what you need.

- Keep existing accounts in good standing to show balance.

- If you’re new to credit, start with one type, like a secured credit card.

6. Don’t Close Old Accounts

The length of your credit history (15% of your score) benefits from older accounts. Closing a credit card you’ve had for years can shorten your history and hurt your score.

Instead:

- Keep old cards active with small, occasional purchases you pay off right away.

- Check that the card has no annual fees before keeping it open.

7. Pay Down Debts

High debt levels can scare lenders, suggesting you’re stretched thin. Paying off debts, especially high-interest ones, can improve your score over time.

Strategies:

- Focus on high-interest debts first, like credit card balances.

- Try the snowball method—pay smallest debts first for quick wins.

- Set up a budget to free up cash for repayments.

8. Be Careful with Joint Accounts

If you share a loan or credit card with someone, their payment habits affect your score. A missed payment by a co-borrower can hurt you both.

Protect yourself:

- Only share accounts with people you trust to pay on time.

- Regularly check joint account statements for issues.

- Consider separate accounts if possible to avoid risks.

Special Scenarios for Credit Building

Not everyone starts from the same place. Here’s how to improve your score in unique situations:

If You Have No Credit History

New to credit? You can build a score from scratch:

- Secured Credit Cards: These require a deposit but are easier to get. Use them responsibly to start your history.

- Authorized User: Ask a family member with a good credit score to add you to their card. Their good habits can boost your score.

- Small Loans: Take a small personal loan and pay it back on time to show reliability.

Rebuilding After Defaults

Had a rough patch with missed payments or defaults? Recovery takes time, but it’s doable:

- Settle Debts: Pay off or negotiate what you owe, but know settlements might still show on your report.

- Start Small: Use a secured card or small loan to rebuild trust with lenders.

- Be Patient: Negative marks fade after 7 years, and good habits help sooner.

For Self-Employed Individuals

Self-employed folks often deal with uneven income, which can make credit tricky. Try these:

- Show Steady Income: Keep records of your earnings to prove stability to lenders.

- Business Credit Cards: Use them for work expenses and pay on time to build credit.

- Separate Finances: Keep personal and business accounts apart for clearer credit reports.

How Long Does It Take to See Results?

The 2025 RBI bi-weekly updates mean your score can change faster, but the timeline depends on where you start:

| Starting Score | Issue | Time to Improve | What to Expect |

|---|---|---|---|

| 700-749 (Good) | Minor late payments | 1-3 months | Could reach 750+ with consistent payments |

| 550-699 (Fair) | High utilization, some misses | 3-6 months | Steady progress with lower debt, timely pays |

| Below 550 (Poor) | Defaults, bankruptcies | 6-12+ months | Slow climb, focus on rebuilding habits |

| No Score | No credit history | 6-12 months | Build history with small, reliable credit |

Small steps, like paying bills on time, can show up in your score within weeks, thanks to the new rules. Bigger fixes, like recovering from a default, take longer but get easier with consistency.

Tools and Resources to Help You

- Free Credit Reports: Check your score for free once a year at CIBIL or Equifax. Learn more in our guide on checking your credit score.

- Payment Apps: Apps like Cred or your bank’s app can remind you of due dates and automate payments.

- Credit Monitoring: Paid services from Experian alert you to score changes or suspicious activity.

Bonus: Use Credit Health Apps

Many apps help you track and manage your credit score in real-time, send reminders, provide insights, and even help with credit report issue disputes.

Top credit score tracking apps in India

Common Mistakes to Avoid

- Ignoring Small Bills: Even a missed utility bill can hurt if reported.

- Maxing Out Cards: High balances, even if paid off, raise your utilization.

- Closing Old Cards: This can shorten your credit history, lowering your score.

- Applying Everywhere: Too many applications make you look desperate.

Concluision

Boosting your credit score in India is all about smart habits – paying bills on time, using credit wisely, and keeping an eye on your report. The 2025 RBI updates make it easier to see progress quickly, with scores refreshing every 15 days. Whether you’re starting fresh, fixing past mistakes, or aiming for a top score, these steps can get you there. Take control today, and you’ll be on your way to better loans, cards, and financial freedom.

FAQs

Recomended Articles:

#creditscoreindia #cibilscore2025 #improvecreditfast #financetipsindia #moneygale #personalfinance2025 #rbifinance #creditcardhacks #loanapprovalindia #financialfreedomindia