Filing your Income Tax Return (ITR) online might sound a bit overwhelming, especially if you’re doing it for the first time. But thanks to the government’s upgraded e-filing portal, the process is now smoother and more user-friendly. Whether you’re a salaried person, a business owner, a pensioner, a housewife, or filing ITR for the first time, this complete guide will walk you through how to file ITR online in India for AY 2025-26, step by step.

Before You Begin: Documents Checklist

Make sure you gather all the required documents based on your category:

- Salaried Person: PAN card, Aadhaar card, Form 16, bank account details, and salary slips

- Business Owner: PAN, Aadhaar, profit & loss statement, GST details, bank account statements

- Pensioner: Pension certificate/slip, Form 16A (if applicable), interest certificates from the bank

- Housewife: Income proofs like interest income, rent receipts, or investment income

- First-Time Filers: PAN, Aadhaar, and any source of income proof (even bank interest)

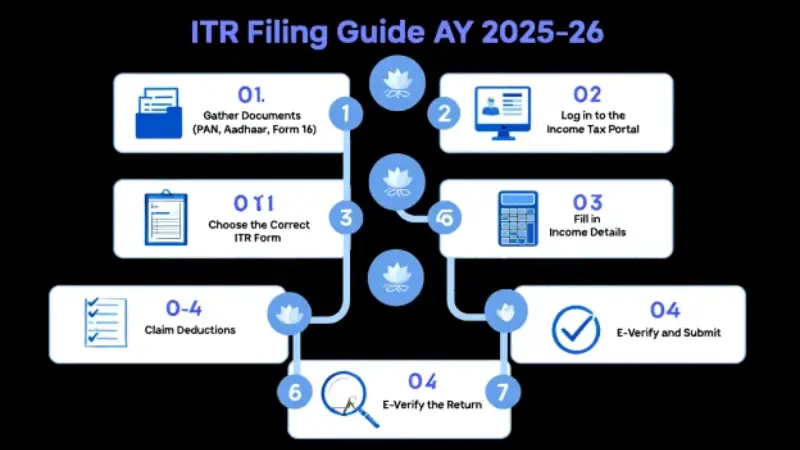

How to File ITR Online Step by Step (AY 2025-26)

Step 1: Visit the Official Portal

Go to https://www.incometax.gov.in – this is the government’s e-filing portal.

Step 2: Log in or Register

- If you’ve filed before, log in using your PAN and password.

- If you’re a new user, click Register using your PAN, Aadhaar, and contact details.

Step 3: Start Your ITR Filing

- Click on e-File > Income Tax Return > File Income Tax Return.

Step 4: Select the Right Assessment Year

- Choose AY 2025-26.

- Select Online as the filing mode.

Step 5: Choose Your Filing Status

- For most individuals, select Individual.

- For businesses or HUFs, select accordingly.

Step 6: Pick the Correct ITR Form

- ITR-1: For salaried persons, pensioners, housewives with basic income

- ITR-2: If you have capital gains or more than one house property

- ITR-3/ITR-4: For business owners or professionals with complex income

Note: As of early June 2025, only ITR-1 and ITR-4 are enabled for online filing. ITR-2 and ITR-3 will be available soon.

Step 7: Fill in Your Income and Deductions

- The system will auto-fill some details – always verify them

- Add income from all sources (salary, pension, rent, interest, etc.)

- Add deductions under 80C, 80D, 80G, etc.

Step 8: Review and Submit

- Double-check all entries

- Click Proceed to Verification

Step 9: E-Verify Your Return

- Use one of the following: Aadhaar OTP, net banking, bank account EVC

- You must verify within 30 days – the sooner, the better!

How to File ITR Online for Salaried Person

If you’re salaried, most of your details will be in Form 16. Log in, select ITR-1, check the auto-filled info, and add deductions. That’s it. Filing ITR online for salaried person is quick and easy.

How to File ITR Online for Business

Business owners should choose ITR-3 or ITR-4. Prepare your P&L statement, GST info, and income details. Carefully input your turnover and expenses. Attach required documents and submit.

How to File ITR Online for Pensioners

Use ITR-1 if your pension is your only income. Log in, verify auto-filled pension details, add interest income, and claim deductions. Simple and fast!

How to File ITR Online for the First Time

If you’ve never filed before:

- Register on the portal using your PAN and Aadhaar

- Collect all income proofs (even small sources)

- Follow the step-by-step guide above

- Use the help section on the portal if needed

How to File Income Tax Return Online for Housewife

If you’re a housewife with income from interest, rent, or investments:

- Choose ITR-1 or ITR-2, depending on complexity

- Be honest about your income

- Add all deduction details

Filing ITR is essential—even if your income is small. It helps build a financial record.

How to File ITR Online in India

Whether you live in Odisha, Delhi, Mumbai, or anywhere else—the steps are the same across India. Just ensure you:

- Use the latest forms

- File before the deadline (usually 31st July 2025 for most individuals)

- E-verify your return on time

How to File ITR Online 2025: Important Changes

- Only ITR-1 and ITR-4 are live on the portal as of now.

- Detailed documentation for deductions is now required.

- Always check the latest updates on the Income Tax portal before filing.

Tax Regimes: Old vs New

You can choose either:

- Old Regime: Allows deductions like 80C, 80D, HRA, etc.

- New Regime: Lower tax rates but no deductions

Choose what benefits you the most.

Final Thoughts: Why Filing Early Matters

The sooner you file, the faster you’ll get your refund (if applicable). Filing your income tax return online is now easier than ever with a clean interface, step-by-step guidance, and simplified verification. So don’t wait until the last minute-file early, stay stress-free, and build a strong financial profile.