Why Every Indian Freelancer Needs a Money Plan

Financial planning for freelancers in India is more important than ever. As freelancing grows across the country, more people are choosing flexible work, whether as writers, designers, coders, or marketers. While this freedom is exciting, the financial side can be tough. Unlike a regular job, freelancers don’t get a fixed salary, paid holidays, or company benefits. Some months you earn well, but in others, paying bills can be a struggle.

Without proper financial planning for freelancers in India, it’s easy to feel stressed about rent, emergencies, or your future goals. But here’s the good news: with the right money plan, you can enjoy your freelance life without constant worry. This guide will show you, step by step, how financial planning for freelancers in India can help you manage your income, save for tough times, pay your taxes, and invest for your future using simple language and practical tips you can start today.

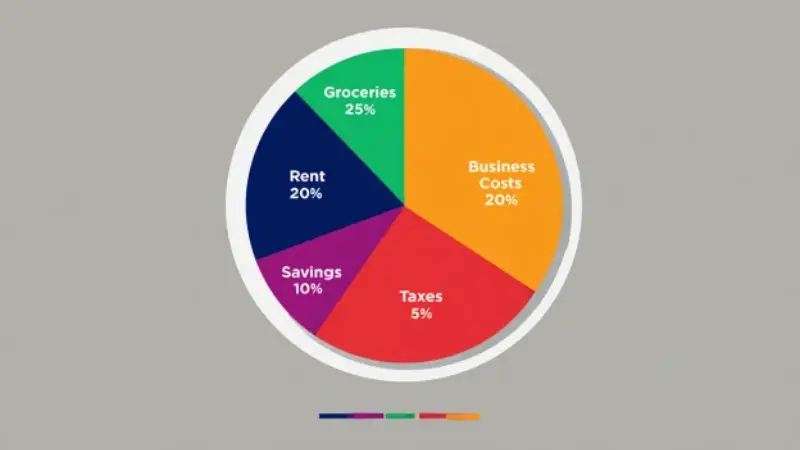

1. Make a Simple Budget (Even If Your Income Changes)

Freelancers don’t get the same amount every month. Without a budget, you might spend too much when you earn more and have nothing left when work is slow. A budget helps you control your money, save for goals, and avoid stress.

- Write down all your fixed expenses (rent, groceries, phone, internet).

- Add your business costs (software, travel, marketing).

- Decide how much you want to save each month.

- When you get paid, first keep money aside for savings and taxes, then spend the rest.

Pro Tip:

Use a free Google Sheet or any budget app to track your money. Update it every week so you always know where you stand.

2. Build an Emergency Fund (Your Safety Net)

Freelancers can have good and bad months. An emergency fund helps you pay your bills if you lose a client or have a sudden expense, like a medical emergency or laptop repair.

- Aim to save at least 3 to 6 months worth of your basic expenses.

- Keep this money in a separate savings account or a liquid mutual fund so you don’t spend it by mistake.

Example:

If your monthly expenses are ₹20,000, your emergency fund should be ₹60,000 to ₹1,20,000.

Pro Tip:

Every time you get paid, put 20% of your income into your emergency fund until you reach your goal.

3. Separate Business and Personal Money

Mixing your freelance money with your personal spending makes it hard to track your profits and pay taxes correctly. Separate accounts make life much easier.

- Open a new bank account just for your freelance payments.

- Pay yourself a “salary” from your business account to your personal account every month.

Pro Tip:

Use UPI or net banking for all client payments and keep a simple record of every transaction.

4. Plan for Taxes (Don’t Let It Be a Surprise)

Freelancers in India have to pay taxes like a business. If you don’t plan, you might end up with a big tax bill at the end of the year.

- If your yearly income is above ₹20 lakh, register for GST.

- Use Section 44ADA to claim a flat 50% expense deduction if you’re a professional.

- Keep digital copies of all your receipts and payments.

- Use free tools like TaxBuddy or Quicko to estimate your tax and pay advance tax every quarter.

Pro Tip:

Set aside 20–30% of each payment for taxes in a separate account, so you’re never caught off guard.

5. Start Investing (Even Small Amounts Matter)

Freelancers don’t get company PF or retirement plans. If you don’t invest, you might struggle in the future even if you earn well today.

- Start a SIP (Systematic Investment Plan) in a mutual fund with as little as ₹500/month.

- Open a PPF (Public Provident Fund) account for safe, long-term savings.

- Consider NPS (National Pension System) for extra retirement benefits and tax savings.

Example:

If you invest ₹1,000/month in a mutual fund for 5 years at 12% return, you’ll have about ₹81,000.

Pro Tip:

Automate your investments so you never miss a month, even during slow periods.

6. Get the Right Insurance

A medical emergency or accident can wipe out your savings. Insurance protects you and your family from big expenses.

- Buy health insurance (at least ₹5 lakh coverage).

- If you have dependents or loans, get a term life insurance plan.

- For some freelancers (like consultants), professional liability insurance is also useful.

Pro Tip:

Compare insurance plans online and read reviews before buying. Don’t just buy the cheapest—look for good claim history and coverage.

7. Plan for Retirement (Start Early, Even If Small)

Freelancers grow old too! The earlier you start saving for retirement, the more your money grows.

- Set a retirement goal (like ₹50 lakh or ₹1 crore).

- Invest regularly in PPF, NPS, or mutual funds.

- Increase your investment as your income grows.

Pro Tip:

Don’t wait for a “big” income to start. Even small amounts add up over time.

8. Build Financial Discipline

Success as a freelancer is not just about earning more, but about managing your money well-every single month.

- Set a monthly reminder to review your budget, savings, and investments.

- Automate your savings and investments so you don’t forget.

- Treat your freelance work like a real business be your own boss and employee.

Pro Tip:

Celebrate small wins-like reaching your emergency fund goal or investing for 12 months straight. This keeps you motivated.

Conclusion: Freelancers Can Be Financially Strong

Freelancing in India is full of opportunities, but also challenges. With a simple plan—budgeting, saving, investing, and protecting yourself-you can enjoy your freedom without money worries.

Start small, stay consistent, and make financial planning a habit. Your future self will thank you!