If you’re looking for the best investing apps for small amounts, you’re in the right place. Many people believe investing requires a lot of money, but that’s no longer true. Today, you can start building wealth with as little as $5 or even less, thanks to user-friendly investing apps.

Whether you’re a beginner or simply want to grow your money gradually, these apps make investing simple, affordable, and accessible. In this guide, we’ll explore the top platforms that allow you to invest small amounts while offering features like fractional shares, low fees, and automated investing.

Top Must-Have Features in Small Investment Apps

When choosing the best investment apps for beginners and small investors in 2025, look for these key features

- Low or no minimum deposit

- Fractional shares

- Low fees

- Easy-to-use interface

- Automated investing

12 Best Investing Apps for Small Amounts 2025

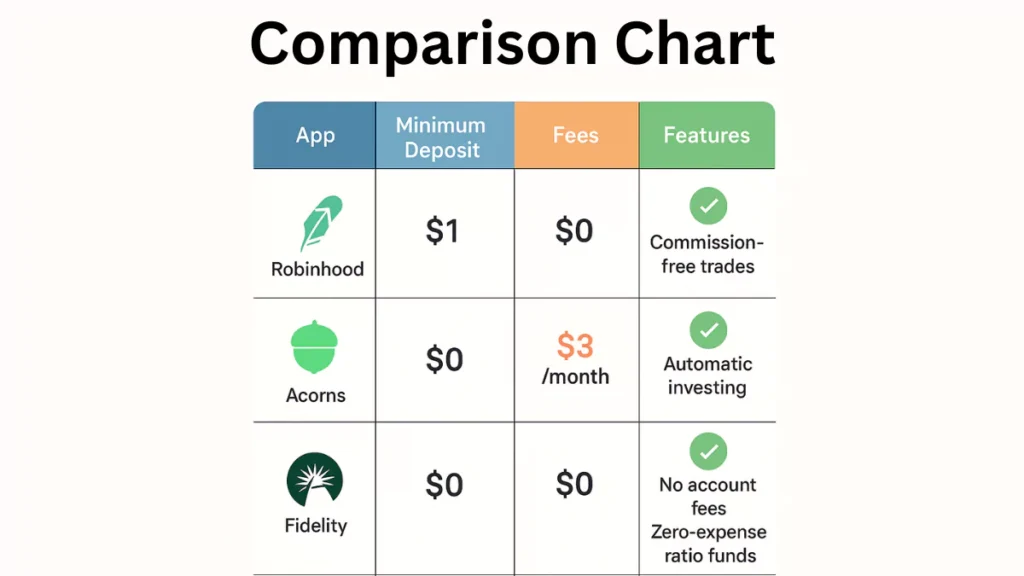

1. Robinhood – Simple, Commission-Free Investing

Robinhood is one of the best investment apps for beginners because of its zero-commission trades and easy-to-use interface. You can buy stocks, ETFs, and even cryptocurrency without paying any trading fees.

Another reason we recommend Robinhood is its fractional shares feature, which lets you invest in high-priced stocks with as little as $1. This makes it perfect for those who want to start investing with small amounts without feeling limited by budget.

- Best for: New investors who want a simple, no-fee way to start.

- Minimum deposit: $1

- Fees: $0

Pro tip: Use recurring investments to automatically buy fractional shares of top stocks like Apple or Amazon with as little as $1.

2. Acorns – Automatically Invest Your Spare Change

Acorns is one of the best micro-investing apps because it turns everyday spending into investments. By rounding up your purchases (e.g., investing the extra 0.25froma0.25froma3.75 coffee), it helps you grow wealth passively.

We also love Acorns for its recurring investment feature, which lets you automatically deposit as little as $5 per week. This makes it ideal for hands-off investors who want a set-it-and-forget-it approach.

- Best for: Passive investors who want automated savings.

- Minimum deposit: $0

- Fees: $3/month

Pro tip: Enable the 10x multiplier to turn a $0.50 round-up into a $5 investment.

3. Fidelity – Long-Term Growth With Zero Fees

Fidelity is a top-rated investment app for long-term investors because it offers no account minimums and zero trading fees. It’s a great choice for those who want to build wealth over time without worrying about costs.

Additionally, Fidelity provides strong research tools and educational resources, making it a smart pick for beginner investors who want to learn while they invest.

- Best for: Retirement-focused and long-term investors.

- Minimum deposit: $0

- Fees: $0

Pro tip: Start with FZROX (Fidelity’s zero-fee total market index fund) for instant diversification.

4. Webull – Advanced Tools and Free Stock Bonuses

Webull stands out among best stock apps for beginners because it offers free stocks when you sign up and has powerful charting tools for those who want to dive deeper into trading.

It’s also a great low-cost investing app with no commissions, making it ideal for active traders who want more control over their investments.

- Best for: Traders who want advanced features.

- Minimum deposit: $0

- Fees: $0

Pro tip: Use the paper trading account to test strategies risk-free before investing real money.

5. Stash – Learn While You Invest

Stash is one of the best apps for beginner investors because it combines investing with education. You can start with just $1, buy fractional shares, and even earn stock rewards for learning.

We also recommend Stash for its themed investment options, which allow you to invest in causes you care about, like clean energy or tech innovation.

- Best for: New investors who want to learn as they go.

- Minimum deposit: $1

- Fees: $3/month

Pro tip: Complete the Stock-Back® rewards program to earn free shares when using your debit card.

6. M1 Finance – Custom Portfolios Made Easy

M1 Finance revolutionizes investing with its “Pie” system for creating custom portfolios. The app automatically rebalances your investments to maintain your target allocation.

We love M1 for letting investors buy fractional shares of entire portfolios. The borrowing feature allows portfolio-backed loans once you reach $10,000.

- Best for: Investors who want custom portfolios with automation.

- Minimum deposit: $0

- Fees: $0

Pro tip: Build a simple “Pie” with 70% ETFs and 30% individual stocks you believe in.

7. SoFi Invest – Free Financial Advisors

SoFi Invest stands out by offering free access to certified financial planners. The app provides both automated investing and active trading options.

We recommend SoFi for its Stock Bits feature that lets you buy fractional shares. Their career coaching and member events add unique value beyond investing.

- Best for: Beginners looking for guidance.

- Minimum deposit: $0

- Fees: $0

Pro tip: Book a free 30-minute financial planning session with a SoFi advisor.

8. Public – Social Investing Community

Public makes investing social by letting you see what others are buying. The app focuses on education with clear explanations of investment terms.

Beyond traditional stocks, Public provides access to alternative assets like contemporary art and collectibles with low minimums. Collecting thematic investments (like space exploration or AI) helps align portfolios with future trends.

- Best for: Community-driven investors.

- Minimum deposit: $0

- Fees: $0

Pro tip: Follow experienced investors to learn strategies before implementing them yourself.

9. Charles Schwab – Best for Retirement

Charles Schwab excels with its retirement planning tools and $0 minimums. The Schwab Slices feature allows fractional investing in S&P 500 companies.

We love Schwab’s excellent 24/7 customer service that provides peace of mind for nervous beginners. Their extensive educational resources provide learning opportunities you won’t find on most apps.

- Best for: Long-term and retirement investors.

- Minimum deposit: $0

- Fees: $0

Pro tip: Open a Schwab Roth IRA and buy SWPPX (Schwab’s S&P 500 index fund) for tax-free growth.

10. Betterment – Automated Investing

Betterment offers professional portfolio management with tax-loss harvesting. The app automatically rebalances and optimizes your investments.

Their Two-Way Sweep feature automatically moves cash between checking and investing accounts to maintain ideal balances. While slightly pricier than some options, the potential tax savings and optimized returns often justify the cost for hands-off investors.

- Best for: Passive investors who want expert management.

- Minimum deposit: $0

- Fees: $4/month

Pro tip: Enable Tax Loss Harvesting to potentially reduce your tax bill.

11. Ellevest – Designed for Women

Elevest addresses unique financial realities for women, such as longevity and career breaks. Their algorithm considers the gender pay gap when projecting future needs – a level of personalization that no other app offers.

We love Ellevest’s Impact Portfolios that invest in women-led companies. The membership includes career coaching and salary negotiation tools.

- Best for: Women seeking gender-specific financial planning.

- Minimum deposit: $0

- Fees: $1–$9/month

Pro tip: Use Ellevest’s salary negotiation tools before your next raise discussion.

12. Fundrise – Entry Level Real Estate Investing

Fundrise makes real estate investing accessible with just $10. The app provides detailed updates on property investments.

We recommend Fundrise for its quarterly dividends and automatic reinvestment. The eREIT structure offers better liquidity than traditional REITs.

- Best for: Investors seeking real estate exposure.

- Minimum deposit: $10

- Fees: 1% annual management fee

Pro tip: Reinvest all dividends to maximize compounding growth.

How to Choose the Right Investing App for Your Needs

Picking the best investing app depends on your financial goals, budget, and investing style.

1. Small Budget ($5–$25 to Start)

Robinhood and Webull allow starting with just $1 and offer fractional shares, ideal for testing investing with minimal risk.

How to Start Investing with $5

- Choose an app like Robinhood or Webull

- Start with as little as $5

- Pick your investment (stocks, ETFs, crypto)

- Watch your investment grow

2. Fully Automated Investing

Acorns and Betterment handle everything, from rounding up spare change to rebalancing your portfolio.

3. Learning to Invest

Stash and SoFi Invest combine education with hands-on experience, perfect for beginners.

4. Retirement

Fidelity and Charles Schwab offer zero-fee IRAs and strong research tools for long-term growth.

5. Alternative Investments (Real Estate or Crypto)

Fundrise allows real estate investment with just $10, while Public offers stocks, crypto, and collectibles.

6. Social or Community-Based Investing

Public has a social network for strategy sharing, and M1 Finance lets you copy expert portfolios.

7. Advanced Trading Tools

Webull and M1 Finance offer detailed charts, technical analysis, and custom portfolios for more control.

Quick Comparison of Best Investing Apps for Small Amounts 2025

App

Best For

Min. Deposit

Fees

Standout Feature

Robinhood

Beginners

$1

$0

Fractional shares

Acorns

Passive investors

$0

$3/mo

Spare-change investing

Fidelity

Long-term growth

$0

$0

Zero-fee index funds

Webull

Active traders

$0

$0

Advanced charts

Stash

Learning

$1

$3/mo

Stock-back rewards

Fundrise

Real estate

$10

1% fee

REIT investments

Conclusion

Investing with small amounts is easier than ever thanks to these user-friendly apps. Whether you want automated investing, stock trading, or long-term wealth-building, there’s an option that fits your budget and goals. The key is to start now, stay consistent, and choose an app that matches your investing style.

Final Recommendations

- Best for Beginners: Robinhood (simple, $1 start) or Stash (learn while investing)

- Best for Passive Investors: Acorns (spare-change rounding) or Betterment (automated portfolios)

- Best for Long-Term Growth: Fidelity (zero-fee funds) or Charles Schwab (retirement focus)

- Best for Alternative Investments: Fundrise (real estate) or Public (crypto/collectibles)

- Best for Active Traders: Webull (free stocks + advanced tools)

Final Tip: Don’t overthink it—pick one app, start with $5, and grow from there!

FAQs

Related Reads

investingapps #smallamountinvesting #investingforbeginners #fractionalshares #microinvesting #robinhood #acorns #fidelity #automatedinvesting #lowfeeinvestment #investinginstocks #etfs #retirementinvesting #passiveinvesting #realestateinvesting #investmentapps2025 #investingtips